Get The Best Deal On Your Auto Insurance Purchase

Insurance is what protects people and keeps them safe and sound when accidents happen. How much car insurance helps is determined by the combination of options that make up the insurance policy. Insurance companies can fluctuate auto insurance costs depending on the company policies and location. In order to get a cheap auto insurance deal, one must look around at different companies’ rates. There are a few steps to consider when looking for cheap auto insurance.

Comparing car insurance rates

Car shopping helps one know good current quotes on car insurance. When an individual is looking for cheap auto insurance rates one should look beyond price. Auto insurance acts as a protective bubble in financial disasters. When looking for cheap car insurance deals, car owners should shop around for the best policies to discover Insurance discounts. When a car owner’s policy comes up for renewal, it is the best time to check on auto rates quoted every year.

Bundling policies

Bundling of policies helps in attaining up to a 30% increase on multi-policy savings depending on a company’s policies. If an individual gets property owners or renters insurance, then they are eligible to attain amazing discounts on their car insurance. A discount of up to 25% can be attained by an individual if they insure multiple vehicles instead of a single individual automobile. Bundling is also favorable to people who are married as the complaints that end up being filed are less in numbers than that of single persons. These discounts are often covered under the collision and comprehensive coverage. But people should consider the cost of purchasing policies separately compared to a bundle deal before deciding.

Raising deductibles

A person can decrease their collision or comprehensive coverage costs on their premium by increasing their deductibles. Higher deductibles can bring savings of about 15-30%. The more you increase your deductible the more you save. However cheap insurance becomes expensive. An individual seeking car insurance should check the interest rates on their credit cards before deciding to increase their deductibles.

Taking advantage of discounts

Most car companies offer students below 25 a good student discount. “A good student”

discount is offered to students who maintain a B average (3.0GPA). With the good student discount, a yearly policy rate is about $5,750 compared to the usual $6,110. Good driver discounts get you around 5-25% worth of savings. Insured individuals can also check on how often they drive their cars, reducing car usage brings about discounts. Having an alarm or anti-theft device gets you about 30% in discounts.

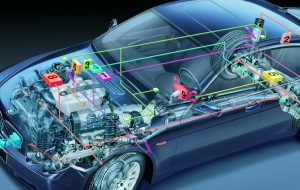

Buying the “right” type of car

A cheap car doesn’t promise one cheap insurance. The specific features a person decides on their car plays a big role in determining the insurance rates they end up paying. A person can consider getting a low maintenance car because it assures cheaper premiums.

Being a good driver

When a driver has a bad driving history, it easily discards them from getting cheap car insurance mostly. Speeding tickets, drunk driving incidents and accidents can cause auto insurance rates to be high. Insurance companies require a clean driving record for a couple of years to give someone discounts.

Not carrying unnecessary insurance coverage

The maximum pay-out on collision and comprehensive coverages is limited by the value of the car. If one has an old car with the low market value it does not make sense to sell out on such coverages.

With several options on getting favorable car insurance, one should do their homework and research enough to find an option that fits their budget.